The IFSCA is a unified regulator aiming to boost business in IFSC, create robust regulations, and enhance global connectivity to serve the Indian economy and the world.

GIFT IFSC

Know more about GIFT IFSC

The Gujarat International Finance Tec-City International Financial Services Centre (GIFT IFSC) is a strategically located financial hub designed to elevate India's global economic standing. Offering a world-class infrastructure, streamlined regulations, and tax concessions, GIFT IFSC aims to attract both domestic and foreign investors. This competitive advantage positions GIFT IFSC as a preferred destination for global financial activities, including banking, insurance, and asset management.

Furthermore, its status as a Special Economic Zone provides a business-friendly environment with simplified procedures. Ultimately, GIFT IFSC strives to be a two-way gateway, facilitating foreign investment into India and enabling Indian entities to invest globally. Supported by the Indian government's proactive policies, GIFT IFSC is well-positioned to become a leading international financial and technological center.

What is IFSCA?

The International Financial Services Centres Authority (IFSCA) is a statutory body established by the Government of India under the International Financial Services Centres Authority Act, 2019. Headquartered at GIFT City, Gujarat.

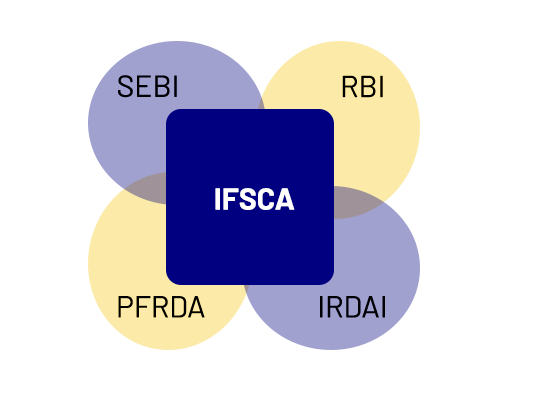

IFSCA established as a unified regulatory body consolidates the regulatory powers of India's four primary financial services authorities within the International Financial Services Centre (IFSC). This eliminates the need for entities operating within the IFSC to navigate the regulations of multiple bodies.

IFSCA assumes the responsibilities previously held by the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Pension Fund Regulatory and Development Authority (PFRDA), and Insurance Regulatory and Development Authority (IRDAI), streamlining the regulatory framework for financial institutions, services, and products within the IFSC

Key Highlights of IFSCA

Unified regulatory hub

Gateway to a developed world

It allows conducting transactions in any foreign currency, fostering seamless inbound and outbound investment.

A catalyst for growth

IFSC propels India's emergence as an economic powerhouse, fostering a compelling ecosystem for financial services businesses on a global scale.

Frequently Asked Questions

What is the currency for transactions in GIFT – IFSC?

To foster a globally integrated financial environment, transactions conducted by units within the GIFT IFSC are denominated in foreign currencies such as USD and AED other than the Indian Rupee (INR). However, for administrative and statutory expenses, IFSC units are permitted to utilize INR though its Special Non-resident Rupee Account.

What is the residency status of entities in GIFT IFSC?

The residency status of entities operating within GIFT IFSC presents a unique situation. For income tax purposes, these entities are considered "resident" in India. However, from a foreign exchange control perspective, they are treated as "non-resident."

What types of FinTech activities are permissible under the GIFT IFSC framework?

The GIFT IFSC framework embraces innovation by allowing a broad range of FinTech activities:

Financial Technology (FinTech) Solutions: This encompasses the development and deployment of technology-driven solutions that introduce novel business models, applications, processes or products within the financial services sector.

Technology Finance (TechFin) Services: This category includes advanced or emerging technology solutions applied to allied areas or activities that support and enhance the operations of financial products, services, and institutions.

Who can invest in an AIF set up in GIFT IFSC

a) Foreign Investors: Individuals or entities residing outside India.

b) Non-Resident Indians (NRIs)

c) Qualified Indian Institutional Investors: These institutions must be eligible under exchange regulations to invest funds offshore, within the limits set for outward investment.

d) High Net Worth Individuals (HNIs): Person resident in India with a minimum net worth of USD 1 million in the preceding financial year, who are eligible to invest funds offshore under the Reserve Bank of India Liberalized Remittance Scheme (LRS).